Filing Services

Let us file the documents you need

Federal Tax ID Number

A federal tax ID (officially known as an Employer Identification Number or EIN) is a unique number assigned to a business or organization by the IRS. A business uses its federal tax ID much like a person uses a Social Security number.

Corporate Admendments

Share Amendment

Corporations and LLCs that decide to change either the value or number of shares of their stock

Entity Conversion

Businesses can switch from one entity type to another without going through the entire process of closing the original entity

Dissolution

When a small business files articles of dissolution, they are officially notifying their local Secretary of State that the business is formally closed

Name Amendment

We can File Articles of Amendment with the state to change your business name

Foreign Qualification

Foreign qualification is the process of registering to do business in a state other than the one in which you incorporated or formed your business

Reinstatement

Bring your business back to where it was before it fell out of compliance

Sellers Permit

A seller’s permit is a permit you apply for from your state to allow you to sell products or services and collect sales tax. The purpose of a seller’s permit is to allow the state to control the process of collecting, reporting, and paying sales tax in that state.

Licenses And Permits Research

As a business owner, you are responsible for making sure your business has the proper federal, state, and local licenses and permits to operate legally. A business license ensures you are legitimately doing business in a particular locale. Every new business must apply for a business license. But, don’t be fooled, your corporation or LLC may need more than one license or permit, to fully operate at the state level.

At StartABizzy.com we take the guesswork out of how to obtain a business license and the necessary permits.

Digital Corporate Kit

Have all your important documents stored and available 24/7 on your secure cloud-based account in your digital corporate kit. These documents will include your original filing papers, your bylaws or operational agreement, your resolutions, and your stock or membership registry.

Apostille Certificate

An Apostille Certificate is a method of certifying a document for use in another country.

An Apostille Certificate copy of the Articles of Incorporation or Articles of Organization is often required to open a bank account in another country for a US-incorporated business. Also, some countries require a Certified Copy of the Articles of Incorporation/Organization with an appropriate gold seal instead of an apostilled copy.

S- Corp Election

S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation on the corporate income.

LLC Operating Agreement

An Operating Agreement is a key document used by LLCs because it outlines the business’ financial and functional decisions including rules, regulations, and provisions. Once the document is signed by the members of the Limited Liability Company, it acts as an official contract binding them to its terms. Use our LLC Operating Agreement to identify your business as a limited liability company and establish how it will operate.

Filing Services

Save yourself the headache and let us file it for you

Federal Tax ID Number

A federal tax ID (officially known as an Employer Identification Number or EIN) is a unique number assigned to a business or organization by the IRS. A business uses its federal tax ID much like a person uses a Social Security number.

The IRS requires most business entities to use a federal tax ID (EIN)—corporations, partnerships, most LLCs, and some sole proprietorships. A federal tax ID offers other benefits, even when it isn’t required by the IRS. For instance, it can help protect against identity theft, and it’s often a prerequisite for opening a business bank account.

Corporate Amendments

Share Amendment

Corporations and LLCs that decide to change either the value or number of shares of their stock

Entity Conversion

Businesses can switch from one entity type to another without going through the entire process of closing the original entity

Name Amendment

We can File Articles of Amendment with the state to change your business name

Business Reinstatement

Bring your business back to where it was before it fell out of compliance

Foreign Qualification

Foreign qualification is the process of registering to do business in a state other than the one in which you incorporated or formed your business

Dissolution

When a small business files articles of dissolution, they are officially notifying their local Secretary of State that the business is formally closed

Sellers Permit

A seller’s permit is a permit you apply for from your state to allow you to sell products or services and collect sales tax. The purpose of a seller’s permit is to allow the state to control the process of collecting, reporting, and paying sales tax in that state.

Certificate Of Good Standing

In certain situations, you may be required to prove that your business exists

Certified Copies

If the original document is ever lost or misplaced, request a Certified Copy

Licenses And Permits Research

As a business owner, you are responsible for making sure your business has the proper federal, state, and local licenses and permits to operate legally. A business license ensures you are legitimately doing business in a particular locale. Every new business must apply for a business license. But, don’t be fooled, your corporation or LLC may need more than one license or permit, to fully operate at the state level.

At StartABizzy.com we take the guesswork out of how to obtain a business license and the necessary permits.

Digital Corporate Kit

Have all your important documents stored and available 24/7 on your secure cloud-based account in your digital corporate kit. These documents will include your original filing papers, your bylaws or operational agreement, your resolutions, and your stock or membership registry.

Apostille Certificate

An Apostille Certificate is a method of certifying a document for use in another country.

An Apostille Certificate copy of the Articles of Incorporation or Articles of Organization is often required to open a bank account in another country for a US-incorporated business. Also, some countries require a Certified Copy of the Articles of Incorporation/Organization with an appropriate gold seal instead of an apostilled copy.

S- Corp Election

S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation on the corporate income.

LLC Operating Agreement

An Operating Agreement is a key document used by LLCs because it outlines the business’ financial and functional decisions including rules, regulations, and provisions. Once the document is signed by the members of the Limited Liability Company, it acts as an official contract binding them to its terms. Use our LLC Operating Agreement to identify your business as a limited liability company and establish how it will operate.

Filing Services

Save yourself the headache and let us file it for you.

Federal Tax ID Number

A federal tax ID (officially known as an Employer Identification Number or EIN) is a unique number assigned to a business or organization by the IRS. A business uses its federal tax ID much like a person uses a Social Security number.

The IRS requires most business entities to use a federal tax ID (EIN)—corporations, partnerships, most LLCs, and some sole proprietorships. A federal tax ID offers other benefits, even when it isn’t required by the IRS. For instance, it can help protect against identity theft, and it’s often a prerequisite for opening a business bank account.

Corporate Amendments

Share Amendment

Corporations and LLCs that decide to change either the value or number of shares of their stock

Business Reinstatement

Bring your business back to where it was before it fell out of compliance

Name Amendment

We can File Articles of Amendment with the state to change your business name

Dissolution

When a small business files articles of dissolution, they are officially notifying their local Secretary of State that the business is formally closed

Foreign Qualification

Foreign qualification is the process of registering to do business in a state other than the one in which you incorporated or formed your business

Entity Conversion

Businesses can switch from one entity type to another without going through the entire process of closing the original entity

Sellers Permit

A seller’s permit is a permit you apply for from your state to allow you to sell products or services and collect sales tax. The purpose of a seller’s permit is to allow the state to control the process of collecting, reporting, and paying sales tax in that state.

Certificate Of Good Standing

In certain situations, you may be required to prove that your business exists

Certified Copies

If the original document is ever lost or misplaced, request a Certified Copy

Licenses And Permits Research

As a business owner, you are responsible for making sure your business has the proper federal, state, and local licenses and permits to operate legally. A business license ensures you are legitimately doing business in a particular locale. Every new business must apply for a business license. But, don’t be fooled, your corporation or LLC may need more than one license or permit, to fully operate at the state level.

At StartABizzy.com we take the guesswork out of how to obtain a business license and the necessary permits.

Digital Corporate Kit

Have all your important documents stored and available 24/7 on your secure cloud-based account in your digital corporate kit. These documents will include your original filing papers, your bylaws or operational agreement, your resolutions, and your stock or membership registry.

Apostille Certificate

An Apostille Certificate is a method of certifying a document for use in another country.

An Apostille Certificate copy of the Articles of Incorporation or Articles of Organization is often required to open a bank account in another country for a US-incorporated business. Also, some countries require a Certified Copy of the Articles of Incorporation/Organization with an appropriate gold seal instead of an apostilled copy.

S- Corp Election

S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation on the corporate income.

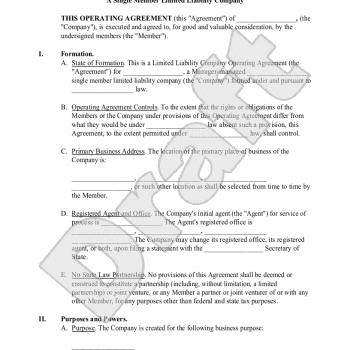

LLC Operating Agreement

An Operating Agreement is a key document used by LLCs because it outlines the business’ financial and functional decisions including rules, regulations, and provisions. Once the document is signed by the members of the Limited Liability Company, it acts as an official contract binding them to its terms. Use our LLC Operating Agreement to identify your business as a limited liability company and establish how it will operate.